Sponsored ads:

Fibonacci Retracement

In finance, Fibonacci retracements is a method of technical analysis for determining support and resistance levels. They are named after their use of the Fibonacci sequence. Fibonacci retracement is based on the idea that markets will retrace a predictable portion of a move, after which they will continue to move in the original direction.

Fibonacci retracement is created by taking two extreme points on a chart and dividing the vertical distance by the key Fibonacci ratios. 0.0% is considered to be the start of the retracement, while 100.0% is a complete reversal to the original part of the move. Once these levels are identified, horizontal lines are drawn and used to identify possible support and resistance levels.

Sponsored ads:

Fibonacci retracement levels shown on the USD/CAD currency pair. In this case, price retraced approximately 38.2% of a move down before continuing.

Fibonacci ratios

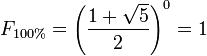

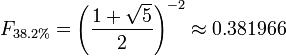

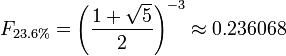

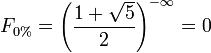

Fibonacci ratios are mathematical relationships, expressed as ratios, derived from the Fibonacci sequence. The key Fibonacci ratios are 0%, 23.6%, 38.2%, and 100%.

Sponsored ads:

The key Fibonacci ratio of 0.618 is derived by dividing any number in the sequence by the number that immediately follows it. For example: 8/13 is approximately 0.6154, and 55/89 is approximately 0.6180.

The 0.382 ratio is found by dividing any number in the sequence by the number that is found two places to the right. For example: 34/89 is approximately 0.3820.

The 0.236 ratio is found by dividing any number in the sequence by the number that is three places to the right. For example: 55/233 is approximately 0.2361.

The 0 ratio is :

Continue to Lesson 5

Sponsored ads: