Sponsored ads:

Broadening top – Buy stock and sell on time

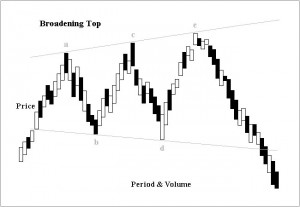

Broadening top is technical analysis chart pattern describing trends of stocks, commodities, currencies, and other assets. It’ll help you decide when to buy stock and when to sell it.

Point of Formation

Broadening Top formation appears much more frequently at tops than at bottoms. It is a difficult formation to trade in. Its formation usually has bearish implications.

Role of Big Players

It is a common saying that smart money is out of market in such formation and market is out of control. In its formation, most of the selling is completed in the early stage by big players and the participation is from general public in the later stage (while big players are waiting for the right time to buy stocks).

Sponsored ads:

Price & Volume

Price keeps on swinging unpredictably and one can’t be sure where the next swing will end. Regarding the shares volume, it is very irregular and leaves no clue to the direction of the next move.

How Broadening Top is formed

In the broadening top formation five minor reversals are followed by a substantial decline.

Five minor reversals a-b-c-d-e

Sponsored ads:

In the figure above, price of the share reverses five times, reversal point d is made at a lower point than reversal point b and reversal point c and e occur successively higher than reversal point a.

One can’t be sure of the trend unless price breaks down the lower of the two points (b & d) and keeps on falling. In the figure below, Broading Top is confirmed. so when is the right time to buy stock, bond, forex or commodity that falls into this form?

Broadening Top confirmation

Continue to the next lesson

Sponsored ads: